13+ Wacc Calculator

The algorithm behind this WACC calculator applies the formula explained here. Weighted average cost of capital percentage of capital that is equity x cost of equity percentage of capital that is debt x.

Weighted Average Cost Of Capital Wacc With Screener Macro Eloquens

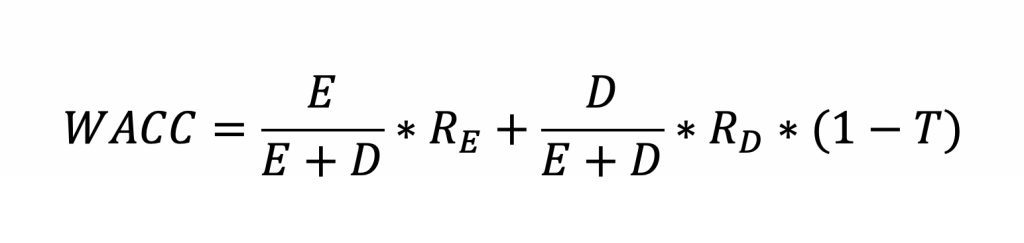

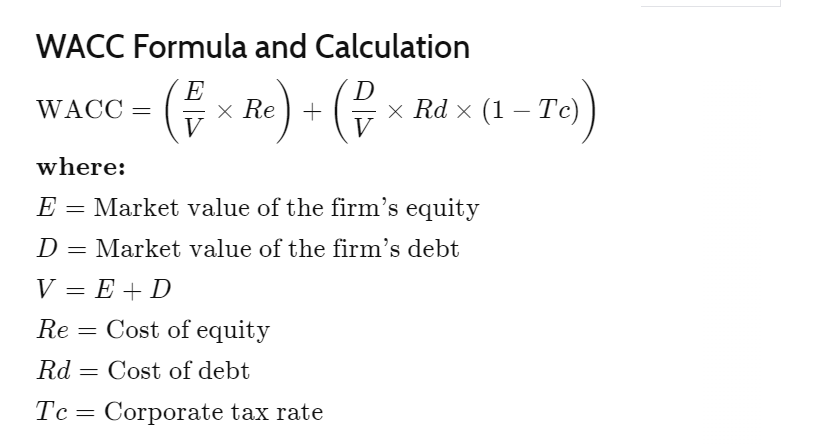

WACC EV x Re DV x Rd x 1 T Where.

. WACC Calculation Example Lets consider that your companys start-ups percentages of equity are 30 and 40 respectively while the percentage of the corporate tax rate is 30. E market value of the firms equity market cap. Fortunately the WACC calculator at Thats WACC does all the hard work for you.

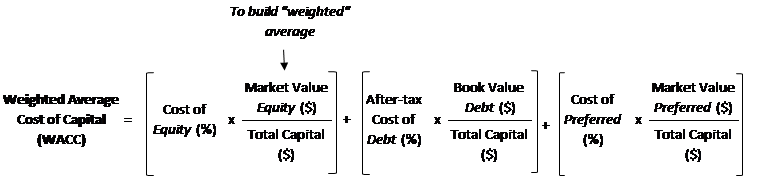

As shown below the WACC formula is. WACC Formula EV Re DV Kd 1 Tax rate E Market Value of Equity V Total market value of equity debt Re Cost of Equity D Market Value of Debt. WACC EV Re DV Rd 1 -.

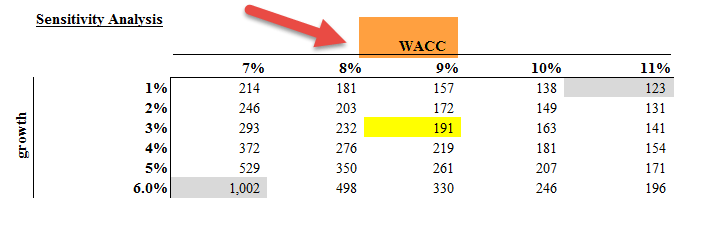

This WACC calculator helps you calculate WACC based on capital structure cost of equity cost of debt and tax rate. Here is a preview of the WACC calculator. It is very often called the hurdle rate.

What is the WACC Formula. Calculating WACC is straight forward when you know what the. W ACC E DE rE D DE rD.

To use it simply. Lets look at the WACC formula first WACC Formula EV Ke DV Kd 1 Tax Now we will put the information for Company. Market value of the firms.

How to Calculate and Interpret the Weighted Average Cost of Capital WACC Why the Weighted Average Cost of Capital WACC Is Flawed as the Discount Rate. Heres the formula to use to calculate WACC. WACC EV Re DV Rd 1 - Tc Elements of the formula Here are the elements in the WACC formula and what they represent.

Input your Cost of Equity Capital. The weighted average cost of capital WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. WACC is calculated by multiplying the cost of each capital source debt and equity by its relevant weight by market value then adding the products together to determine the.

WACC is a very important metric and used in investment decisions. This calculator will calculate using the appropriate formula for weighted Average Cost of Capital WACC Cost of Equity Capital in. Using the WACC calculator Our online Weighted Average Cost of Capital WACC calculator is a convenient tool to determine the cost of raising capital for any business.

Enter a stock ticker symbol for any public company and Thats WACC pulls back 3 years of Income. Cost of debt Rd as a rate. We need to calculate WACC for both of these companies.

Corporate Tax Rate Ctr as a percent.

Cost Of Capital Calculator Tutorial Analystix

Best Excel Tutorial How To Calculate Wacc In Excel

Value Versus Growth Stocks Ii Networks

Wacc Formula Calculator Example With Excel Template

Treasury Cafe March 2014

Understanding The Weighted Average Cost Of Capital Wacc By Dobromir Dikov Fcca Magnimetrics Medium

Hspice User Guide Department Of Electrical Computer And

Weighted Average Cost Of Capital Wacc Formula Calculations

Part 2 How To Calculate The Wacc Of A Company In Excel Youtube

Warner Music Group 10 K 2012 12 13 Pdf Form 10 K Music Industry

Solution Img 20220901 163131 1 2 Studypool

Wacc Calculator And Step By Step Guide Discoverci

Weighted Average Cost Of Capital Wacc Financial Edge

Scielo Brasil Market Value Calculation And The Solution Of Circularity Between Value And The Weighted Average Cost Of Capital Wacc Market Value Calculation And The Solution Of Circularity Between Value

Wacc Formula Excel Overview Calculation And Example

Calculate Weighted Average Cost Of Capital Wacc Using Python By Reda Aldahan Python In Plain English

Weighted Average Cost Of Capital Guide Wacc Calculator Excel Download